Page 12 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 12

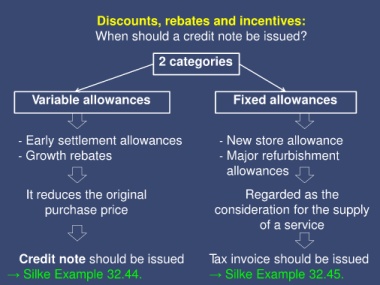

Discounts, rebates and incentives:

When should a credit note be issued?

2 categories

Variable allowances Fixed allowances

- Early settlement allowances - New store allowance

- Growth rebates - Major refurbishment

allowances

It reduces the original Regarded as the

purchase price consideration for the supply

of a service

Credit note should be issued Tax invoice should be issued

→ Silke Example 32.44. → Silke Example 32.45.