Page 10 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 10

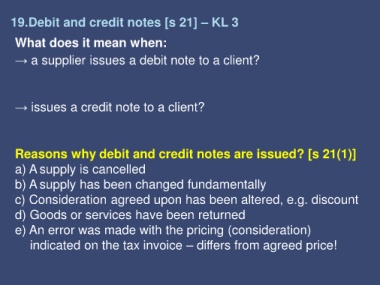

19.Debit and credit notes [s 21] – KL 3

What does it mean when:

→ a supplier issues a debit note to a client?

→ issues a credit note to a client?

Reasons why debit and credit notes are issued? [s 21(1)]

a) A supply is cancelled

b) A supply has been changed fundamentally

c) Consideration agreed upon has been altered, e.g. discount

d) Goods or services have been returned

e) An error was made with the pricing (consideration)

indicated on the tax invoice – differs from agreed price!