Page 11 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 11

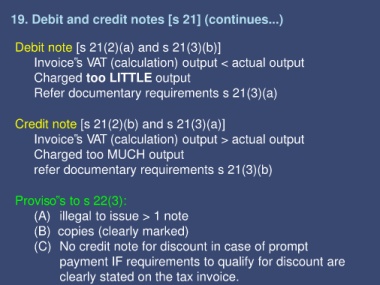

19. Debit and credit notes [s 21] (continues...)

Debit note [s 21(2)(a) and s 21(3)(b)]

Invoice‟s VAT (calculation) output < actual output

Charged too LITTLE output

Refer documentary requirements s 21(3)(a)

Credit note [s 21(2)(b) and s 21(3)(a)]

Invoice‟s VAT (calculation) output > actual output

Charged too MUCH output

refer documentary requirements s 21(3)(b)

Proviso‟s to s 22(3):

(A) illegal to issue > 1 note

(B) copies (clearly marked)

(C) No credit note for discount in case of prompt

payment IF requirements to qualify for discount are

clearly stated on the tax invoice.