Page 5 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 5

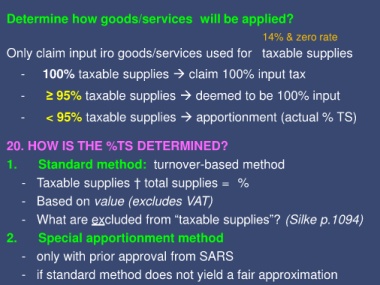

Determine how goods/services will be applied?

14% & zero rate

Only claim input iro goods/services used for taxable supplies

- 100% taxable supplies claim 100% input tax

- ≥ 95% taxable supplies deemed to be 100% input

- < 95% taxable supplies apportionment (actual % TS)

20. HOW IS THE %TS DETERMINED?

1. Standard method: turnover-based method

- Taxable supplies † total supplies = %

- Based on value (excludes VAT)

- What are excluded from “taxable supplies”? (Silke p.1094)

2. Special apportionment method

- only with prior approval from SARS

- if standard method does not yield a fair approximation