Page 20 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 20

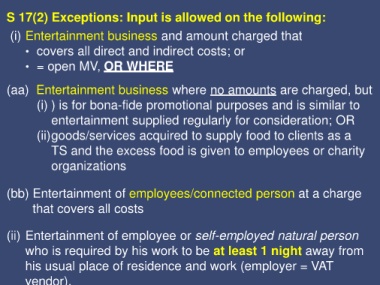

S 17(2) Exceptions: Input is allowed on the following:

(i) Entertainment business and amount charged that

• covers all direct and indirect costs; or

• = open MV, OR WHERE

(aa) Entertainment business where no amounts are charged, but

(i) ) is for bona-fide promotional purposes and is similar to

entertainment supplied regularly for consideration; OR

(ii)goods/services acquired to supply food to clients as a

TS and the excess food is given to employees or charity

organizations

(bb) Entertainment of employees/connected person at a charge

that covers all costs

(ii) Entertainment of employee or self-employed natural person

who is required by his work to be at least 1 night away from

his usual place of residence and work (employer = VAT

vendor).