Page 133 - Microsoft Word - 00 P1 IW Prelims.docx

P. 133

Risk and the risk management process

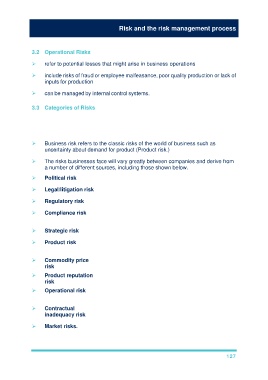

3.2 Operational Risks

refer to potential losses that might arise in business operations

include risks of fraud or employee malfeasance, poor quality production or lack of

inputs for production

can be managed by internal control systems.

3.3 Categories of Risks

NB In the exam you may be required to identify risks, or types of risk, facing a

business. The risks listed below are not exhaustive but illustrate many of the typical

risks that affect a business.

Business risk refers to the classic risks of the world of business such as

uncertainty about demand for product (Product risk.)

The risks businesses face will vary greatly between companies and derive from

a number of different sources, including those shown below.

Political risk Risk due to political instability

Legal/litigation risk Risk that litigation will be brought against business

Regulatory risk Risk of changes in regulation affecting business

Compliance risk Risk of non-compliance with law resulting in fines,

penalties, etc.

Strategic risk Risk that business strategies (e.g. acquisitions) will fail

Product risk Risk of failure of new products/loss of interest in existing

products

Commodity price Risk of a rise in commodity prices (e.g. oil)

risk

Product reputation Risk of change in product’s reputation or image

risk

Operational risk Risk that business operations may be inefficient or

business changes may fail

Contractual Risk that the terms of a contract do not fully cover a

inadequacy risk business against all potential outcomes

Market risks. Risks which derive from the sector in which the business

is operating, and from its customers.

127