Page 41 - BA2 Integrated Workbook - Student 2017

P. 41

Analysing and predicting costs

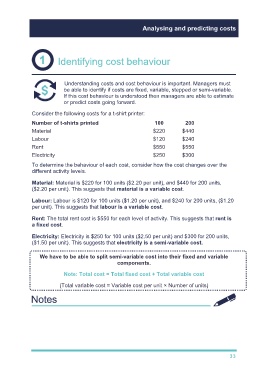

Identifying cost behaviour

Understanding costs and cost behaviour is important. Managers must

be able to identify if costs are fixed, variable, stepped or semi-variable.

If this cost behaviour is understood then managers are able to estimate

or predict costs going forward.

Consider the following costs for a t-shirt printer:

Number of t-shirts printed 100 200

Material $220 $440

Labour $120 $240

Rent $550 $550

Electricity $250 $300

To determine the behaviour of each cost, consider how the cost changes over the

different activity levels.

Material: Material is $220 for 100 units ($2.20 per unit), and $440 for 200 units,

($2.20 per unit). This suggests that material is a variable cost.

Labour: Labour is $120 for 100 units ($1.20 per unit), and $240 for 200 units, ($1.20

per unit). This suggests that labour is a variable cost.

Rent: The total rent cost is $550 for each level of activity. This suggests that rent is

a fixed cost.

Electricity: Electricity is $250 for 100 units ($2.50 per unit) and $300 for 200 units,

($1.50 per unit). This suggests that electricity is a semi-variable cost.

We have to be able to split semi-variable cost into their fixed and variable

components.

Note: Total cost = Total fixed cost + Total variable cost

(Total variable cost = Variable cost per unit × Number of units)

TYU 1

33