Page 42 - BA2 Integrated Workbook - Student 2017

P. 42

Chapter 3

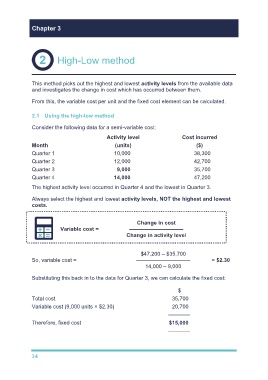

High-Low method

This method picks out the highest and lowest activity levels from the available data

and investigates the change in cost which has occurred between them.

From this, the variable cost per unit and the fixed cost element can be calculated.

2.1 Using the high-low method

Consider the following data for a semi-variable cost:

Activity level Cost incurred

Month (units) ($)

Quarter 1 10,000 38,300

Quarter 2 12,000 42,700

Quarter 3 9,000 35,700

Quarter 4 14,000 47,200

The highest activity level occurred in Quarter 4 and the lowest in Quarter 3.

Always select the highest and lowest activity levels, NOT the highest and lowest

costs.

Change in cost

Variable cost = ––––––––––––––––––

Change in activity level

$47,200 – $35,700

So, variable cost = –––––––––––––––––– = $2.30

14,000 – 9,000

Substituting this back in to the data for Quarter 3, we can calculate the fixed cost:

$

Total cost 35,700

Variable cost (9,000 units × $2.30) 20,700

————

Therefore, fixed cost $15,000

————

34