Page 391 - SBR Integrated Workbook STUDENT S18-J19

P. 391

UK GAAP

UK GAAP differences

2.1 Differences

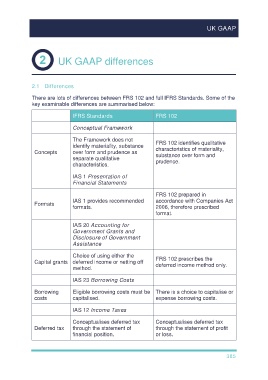

There are lots of differences between FRS 102 and full IFRS Standards. Some of the

key examinable differences are summarised below:

IFRS Standards FRS 102

Conceptual Framework

The Framework does not FRS 102 identifies qualitative

identify materiality, substance

Concepts over form and prudence as characteristics of materiality,

substance over form and

separate qualitative prudence.

characteristics.

IAS 1 Presentation of

Financial Statements

FRS 102 prepared in

IAS 1 provides recommended accordance with Companies Act

Formats

formats. 2006, therefore prescribed

format.

IAS 20 Accounting for

Government Grants and

Disclosure of Government

Assistance

Choice of using either the FRS 102 prescribes the

Capital grants deferred income or netting off deferred income method only.

method.

IAS 23 Borrowing Costs

Borrowing Eligible borrowing costs must be There is a choice to capitalise or

costs capitalised. expense borrowing costs.

IAS 12 Income Taxes

Conceptualises deferred tax Conceptualises deferred tax

Deferred tax through the statement of through the statement of profit

financial position. or loss.

385