Page 392 - SBR Integrated Workbook STUDENT S18-J19

P. 392

Chapter 24

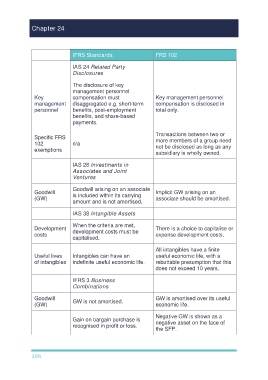

IFRS Standards FRS 102

IAS 24 Related Party

Disclosures

The disclosure of key

management personnel

Key compensation must Key management personnel

management disaggregated e.g. short-term compensation is disclosed in

personnel benefits, post-employment total only.

benefits, and share-based

payments.

Transactions between two or

Specific FRS more members of a group need

102 n/a not be disclosed as long as any

exemptions

subsidiary is wholly owned.

IAS 28 Investments in

Associates and Joint

Ventures

Goodwill arising on an associate

Goodwill is included within its carrying Implicit GW arising on an

(GW) associate should be amortised.

amount and is not amortised.

IAS 38 Intangible Assets

When the criteria are met,

Development development costs must be There is a choice to capitalise or

costs expense development costs.

capitalised.

All intangibles have a finite

Useful lives Intangibles can have an useful economic life, with a

of intangibles indefinite useful economic life. rebuttable presumption that this

does not exceed 10 years.

IFRS 3 Business

Combinations

Goodwill GW is not amortised. GW is amortised over its useful

(GW) economic life.

Negative GW is shown as a

Gain on bargain purchase is

negative asset on the face of

recognised in profit or loss.

the SFP.

386