Page 403 - SBR Integrated Workbook STUDENT S18-J19

P. 403

Answers

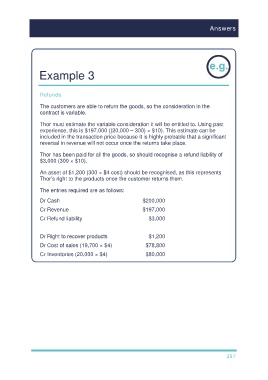

Example 3

Refunds

The customers are able to return the goods, so the consideration in the

contract is variable.

Thor must estimate the variable consideration it will be entitled to. Using past

experience, this is $197,000 ((20,000 – 300) × $10). This estimate can be

included in the transaction price because it is highly probable that a significant

reversal in revenue will not occur once the returns take place.

Thor has been paid for all the goods, so should recognise a refund liability of

$3,000 (300 × $10).

An asset of $1,200 (300 × $4 cost) should be recognised, as this represents

Thor’s right to the products once the customer returns them.

The entries required are as follows:

Dr Cash $200,000

Cr Revenue $197,000

Cr Refund liability $3,000

Dr Right to recover products $1,200

Dr Cost of sales (19,700 × $4) $78,800

Cr Inventories (20,000 × $4) $80,000

397