Page 405 - SBR Integrated Workbook STUDENT S18-J19

P. 405

Answers

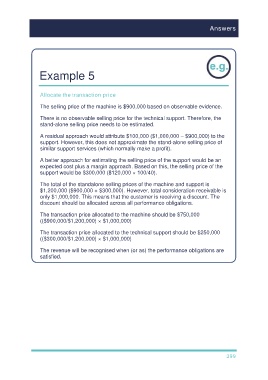

Example 5

Allocate the transaction price

The selling price of the machine is $900,000 based on observable evidence.

There is no observable selling price for the technical support. Therefore, the

stand-alone selling price needs to be estimated.

A residual approach would attribute $100,000 ($1,000,000 – $900,000) to the

support. However, this does not approximate the stand-alone selling price of

similar support services (which normally make a profit).

A better approach for estimating the selling price of the support would be an

expected cost plus a margin approach. Based on this, the selling price of the

support would be $300,000 ($120,000 × 100/40).

The total of the standalone selling prices of the machine and support is

$1,200,000 ($900,000 + $300,000). However, total consideration receivable is

only $1,000,000. This means that the customer is receiving a discount. The

discount should be allocated across all performance obligations.

The transaction price allocated to the machine should be $750,000

(($900,000/$1,200,000) × $1,000,000)

The transaction price allocated to the technical support should be $250,000

(($300,000/$1,200,000) × $1,000,000)

The revenue will be recognised when (or as) the performance obligations are

satisfied.

399