Page 414 - SBR Integrated Workbook STUDENT S18-J19

P. 414

Chapter 25

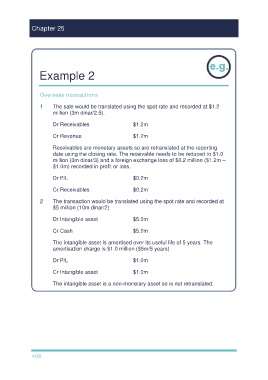

Example 2

Overseas transactions

1 The sale would be translated using the spot rate and recorded at $1.2

million (3m dinar/2.5).

Dr Receivables $1.2m

Cr Revenue $1.2m

Receivables are monetary assets so are retranslated at the reporting

date using the closing rate. The receivable needs to be reduced to $1.0

million (3m dinar/3) and a foreign exchange loss of $0.2 million ($1.2m –

$1.0m) recorded in profit or loss.

Dr P/L $0.2m

Cr Receivables $0.2m

2 The transaction would be translated using the spot rate and recorded at

$5 million (10m dinar/2)

Dr Intangible asset $5.0m

Cr Cash $5.0m

The intangible asset is amortised over its useful life of 5 years. The

amortisation charge is $1.0 million ($5m/5 years)

Dr P/L $1.0m

Cr Intangible asset $1.0m

The intangible asset is a non-monetary asset so is not retranslated.

408