Page 419 - SBR Integrated Workbook STUDENT S18-J19

P. 419

Answers

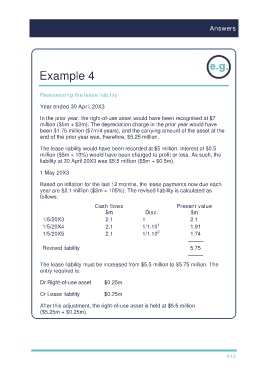

Example 4

Reassessing the lease liability

Year ended 30 April 20X3

In the prior year, the right-of-use asset would have been recognised at $7

million ($5m + $2m). The depreciation charge in the prior year would have

been $1.75 million ($7m/4 years), and the carrying amount of the asset at the

end of the prior year was, therefore, $5.25 million.

The lease liability would have been recorded at $5 million. Interest of $0.5

million ($5m × 10%) would have been charged to profit or loss. As such, the

liability at 30 April 20X3 was $5.5 million ($5m + $0.5m).

1 May 20X3

Based on inflation for the last 12 months, the lease payments now due each

year are $2.1 million ($2m × 105%). The revised liability is calculated as

follows:

Cash flows Present value

$m Disc. $m

1/5/20X3 2.1 1 2.1

1/5/20X4 2.1 1/1.10 1 1.91

1/5/20X5 2.1 1/1.10 2 1.74

–––––

Revised liability 5.75

–––––

The lease liability must be increased from $5.5 million to $5.75 million. The

entry required is:

Dr Right-of-use asset $0.25m

Cr Lease liability $0.25m

After this adjustment, the right-of-use asset is held at $5.5 million

($5.25m + $0.25m).

413