Page 423 - SBR Integrated Workbook STUDENT S18-J19

P. 423

Answers

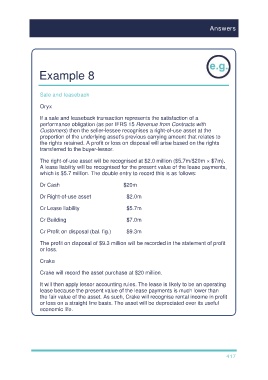

Example 8

Sale and leaseback

Oryx

If a sale and leaseback transaction represents the satisfaction of a

performance obligation (as per IFRS 15 Revenue from Contracts with

Customers) then the seller-lessee recognises a right-of-use asset at the

proportion of the underlying asset’s previous carrying amount that relates to

the rights retained. A profit or loss on disposal will arise based on the rights

transferred to the buyer-lessor.

The right-of-use asset will be recognised at $2.0 million ($5.7m/$20m × $7m).

A lease liability will be recognised for the present value of the lease payments,

which is $5.7 million. The double entry to record this is as follows:

Dr Cash $20m

Dr Right-of-use asset $2.0m

Cr Lease liability $5.7m

Cr Building $7.0m

Cr Profit on disposal (bal. fig.) $9.3m

The profit on disposal of $9.3 million will be recorded in the statement of profit

or loss.

Crake

Crake will record the asset purchase at $20 million.

It will then apply lessor accounting rules. The lease is likely to be an operating

lease because the present value of the lease payments is much lower than

the fair value of the asset. As such, Crake will recognise rental income in profit

or loss on a straight line basis. The asset will be depreciated over its useful

economic life.

417