Page 426 - SBR Integrated Workbook STUDENT S18-J19

P. 426

Chapter 25

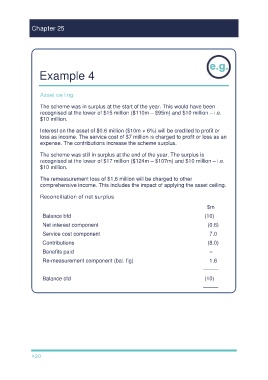

Example 4

Asset ceiling

The scheme was in surplus at the start of the year. This would have been

recognised at the lower of $15 million ($110m – $95m) and $10 million – i.e.

$10 million.

Interest on the asset of $0.6 million ($10m × 6%) will be credited to profit or

loss as income. The service cost of $7 million is charged to profit or loss as an

expense. The contributions increase the scheme surplus.

The scheme was still in surplus at the end of the year. The surplus is

recognised at the lower of $17 million ($124m – $107m) and $10 million – i.e.

$10 million.

The remeasurement loss of $1.6 million will be charged to other

comprehensive income. This includes the impact of applying the asset ceiling.

Reconciliation of net surplus

$m

Balance bfd (10)

Net interest component (0.6)

Service cost component 7.0

Contributions (8.0)

Benefits paid –

Re-measurement component (bal. fig) 1.6

–––––

Balance cfd (10)

–––––

420