Page 430 - SBR Integrated Workbook STUDENT S18-J19

P. 430

Chapter 25

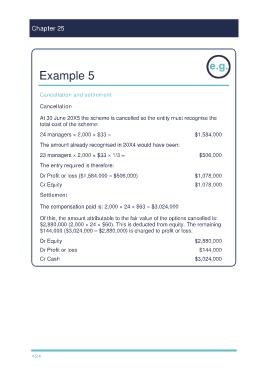

Example 5

Cancellation and settlement

Cancellation

At 30 June 20X5 the scheme is cancelled so the entity must recognise the

total cost of the scheme:

24 managers × 2,000 × $33 = $1,584,000

The amount already recognised in 20X4 would have been:

23 managers × 2,000 × $33 × 1/3 = $506,000

The entry required is therefore:

Dr Profit or loss ($1,584,000 – $506,000) $1,078,000

Cr Equity $1,078,000

Settlement

The compensation paid is: 2,000 × 24 × $63 = $3,024,000

Of this, the amount attributable to the fair value of the options cancelled is:

$2,880,000 (2,000 × 24 × $60). This is deducted from equity. The remaining

$144,000 ($3,024,000 – $2,880,000) is charged to profit or loss:

Dr Equity $2,880,000

Dr Profit or loss $144,000

Cr Cash $3,024,000

424