Page 463 - SBR Integrated Workbook STUDENT S18-J19

P. 463

Answers

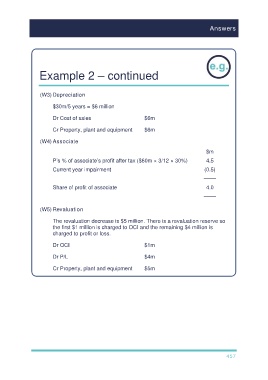

Example 2 – continued

(W3) Depreciation

$30m/5 years = $6 million

Dr Cost of sales $6m

Cr Property, plant and equipment $6m

(W4) Associate

$m

P’s % of associate’s profit after tax ($60m × 3/12 × 30%) 4.5

Current year impairment (0.5)

––––

Share of profit of associate 4.0

––––

(W5) Revaluation

The revaluation decrease is $5 million. There is a revaluation reserve so

the first $1 million is charged to OCI and the remaining $4 million is

charged to profit or loss.

Dr OCI $1m

Dr P/L $4m

Cr Property, plant and equipment $5m

457