Page 478 - SBR Integrated Workbook STUDENT S18-J19

P. 478

Chapter 25

Example 3

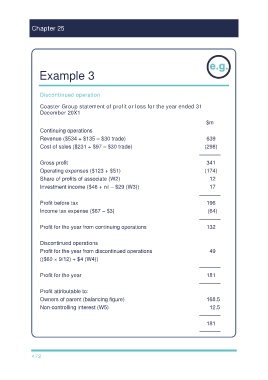

Discontinued operation

Coaster Group statement of profit or loss for the year ended 31

December 20X1

$m

Continuing operations

Revenue ($534 + $135 – $30 trade) 639

Cost of sales ($231 + $97 – $30 trade) (298)

–––––––

Gross profit 341

Operating expenses ($123 + $51) (174)

Share of profits of associate (W2) 12

Investment income ($46 + nil – $29 (W3)) 17

–––––––

Profit before tax 196

Income tax expense ($67 – $3) (64)

–––––––

Profit for the year from continuing operations 132

Discontinued operations

Profit for the year from discontinued operations 49

(($60 × 9/12) + $4 (W4))

–––––––

Profit for the year 181

–––––––

Profit attributable to:

Owners of parent (balancing figure) 168.5

Non-controlling interest (W5) 12.5

–––––––

181

–––––––

472