Page 159 - Microsoft Word - 00 P1 IW Prelims.docx

P. 159

Hedging foreign exchange risk

Money Market Hedges (MMH)

5.1 Basic idea

Avoid future (uncertain) exchange rate by making exchange now

at (known) spot rate.

This is achieved by depositing/borrowing the foreign currency until

the actual commercial transaction cash flows occur.

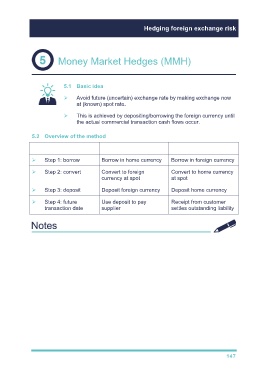

5.2 Overview of the method

Future foreign CF? Payment Receipt

Step 1: borrow Borrow in home currency Borrow in foreign currency

Step 2: convert Convert to foreign Convert to home currency

currency at spot at spot

Step 3: deposit Deposit foreign currency Deposit home currency

Step 4: future Use deposit to pay Receipt from customer

transaction date supplier settles outstanding liability

147