Page 161 - Microsoft Word - 00 P1 IW Prelims.docx

P. 161

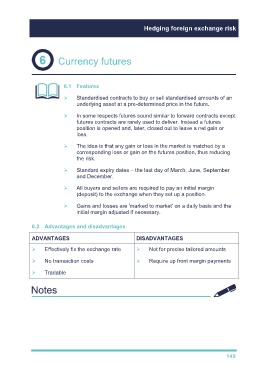

Hedging foreign exchange risk

Currency futures

6.1 Features

Standardised contracts to buy or sell standardised amounts of an

underlying asset at a pre-determined price in the future.

In some respects futures sound similar to forward contracts except

futures contracts are rarely used to deliver. Instead a futures

position is opened and, later, closed out to leave a net gain or

loss.

The idea is that any gain or loss in the market is matched by a

corresponding loss or gain on the futures position, thus reducing

the risk.

Standard expiry dates – the last day of March, June, September

and December.

All buyers and sellers are required to pay an initial margin

(deposit) to the exchange when they set up a position.

Gains and losses are 'marked to market' on a daily basis and the

initial margin adjusted if necessary.

6.2 Advantages and disadvantages

ADVANTAGES DISADVANTAGES

Effectively fix the exchange rate Not for precise tailored amounts

No transaction costs Require up front margin payments

Tradable

149