Page 3 - F6 Slide - VAT Part 3 - Lecture Day 5

P. 3

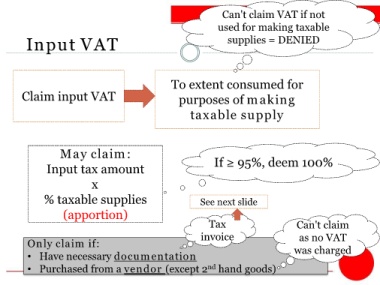

Can't claim VAT if not

used for making taxable

Input VAT supplies = DENIED

To extent consumed for

Claim input VAT purposes of making

taxable supply

May claim:

Input tax amount If ≥ 95%, deem 100%

x

% taxable supplies See next slide

(apportion)

Tax Can't claim

invoice as no VAT

Only claim if:

• Have necessary documentation was charged

• Purchased from a vendor (except 2 nd hand goods)