Page 8 - F6 Slide - VAT Part 3 - Lecture Day 5

P. 8

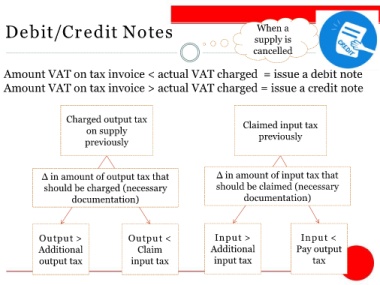

Debit/Credit Notes When a

supply is

cancelled

Amount VAT on tax invoice < actual VAT charged = issue a debit note

Amount VAT on tax invoice > actual VAT charged = issue a credit note

Charged output tax Claimed input tax

on supply previously

previously

Δ in amount of output tax that Δ in amount of input tax that

should be charged (necessary should be claimed (necessary

documentation) documentation)

Output > Output < Input > Input <

Additional Claim Additional Pay output

output tax input tax input tax tax