Page 7 - F6 Slide - VAT Part 3 - Lecture Day 5

P. 7

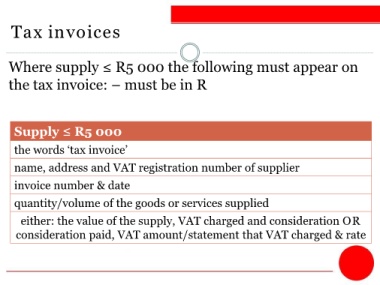

Tax invoices

Where supply ≤ R5 000 the following must appear on

the tax invoice: – must be in R

Supply ≤ R5 000

the words ‘tax invoice’

name, address and VAT registration number of supplier

invoice number & date

quantity/volume of the goods or services supplied

either: the value of the supply, VAT charged and consideration OR

consideration paid, VAT amount/statement that VAT charged & rate