Page 27 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 27

READINGS 1 AND 2: CFA INSTITUTE CODE OF ETHICS AND STANDARDS OF

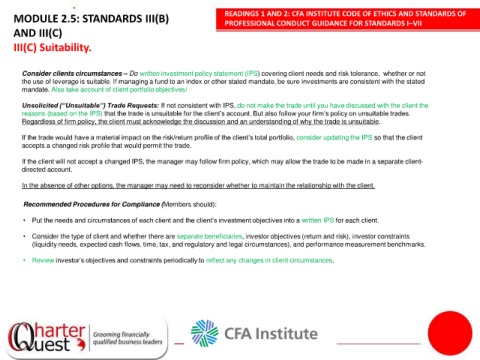

MODULE 2.5: STANDARDS III(B)

PROFESSIONAL CONDUCT GUIDANCE FOR STANDARDS I–VII

AND III(C)

III(C) Suitability.

Consider clients circumstances – Do written investment policy statement (IPS) covering client needs and risk tolerance, whether or not

the use of leverage is suitable. If managing a fund to an index or other stated mandate, be sure investments are consistent with the stated

mandate. Also take account of client portfolio objectives!

Unsolicited (‘’Unsuitable’’) Trade Requests: If not consistent with IPS, do not make the trade until you have discussed with the client the

reasons (based on the IPS) that the trade is unsuitable for the client’s account. But also follow your firm’s policy on unsuitable trades.

Regardless of firm policy, the client must acknowledge the discussion and an understanding of why the trade is unsuitable.

If the trade would have a material impact on the risk/return profile of the client’s total portfolio, consider updating the IPS so that the client

1

accepts a changed risk profile that would permit the trade.

If the client will not accept a changed IPS, the manager may follow firm policy, which may allow the trade to be made in a separate client-

directed account.

In the absence of other options, the manager may need to reconsider whether to maintain the relationship with the client.

Recommended Procedures for Compliance (Members should):

• Put the needs and circumstances of each client and the client’s investment objectives into a written IPS for each client.

• Consider the type of client and whether there are separate beneficiaries, investor objectives (return and risk), investor constraints

(liquidity needs, expected cash flows, time, tax, and regulatory and legal circumstances), and performance measurement benchmarks.

• Review investor’s objectives and constraints periodically to reflect any changes in client circumstances.