Page 28 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 28

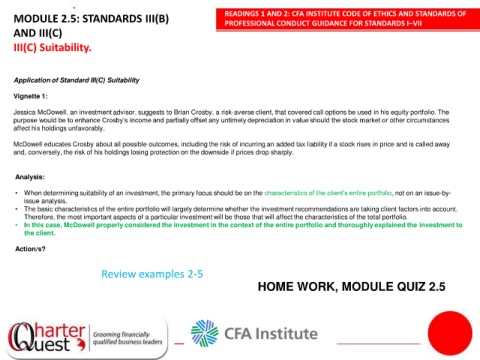

READINGS 1 AND 2: CFA INSTITUTE CODE OF ETHICS AND STANDARDS OF

MODULE 2.5: STANDARDS III(B)

PROFESSIONAL CONDUCT GUIDANCE FOR STANDARDS I–VII

AND III(C)

III(C) Suitability.

Application of Standard III(C) Suitability

Vignette 1:

Jessica McDowell, an investment advisor, suggests to Brian Crosby, a risk-averse client, that covered call options be used in his equity portfolio. The

purpose would be to enhance Crosby’s income and partially offset any untimely depreciation in value should the stock market or other circumstances

affect his holdings unfavorably.

McDowell educates Crosby about all possible outcomes, including the risk of incurring an added tax liability if a stock rises in price and is called away

1

and, conversely, the risk of his holdings losing protection on the downside if prices drop sharply.

Analysis:

• When determining suitability of an investment, the primary focus should be on the characteristics of the client’s entire portfolio, not on an issue-by-

issue analysis.

• The basic characteristics of the entire portfolio will largely determine whether the investment recommendations are taking client factors into account.

Therefore, the most important aspects of a particular investment will be those that will affect the characteristics of the total portfolio.

• In this case, McDowell properly considered the investment in the context of the entire portfolio and thoroughly explained the investment to

the client.

Action/s?

Review examples 2-5

HOME WORK, MODULE QUIZ 2.5