Page 29 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 29

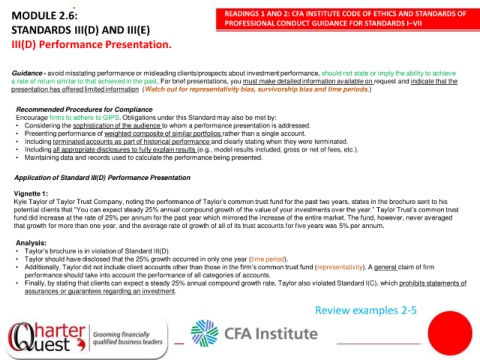

MODULE 2.6: READINGS 1 AND 2: CFA INSTITUTE CODE OF ETHICS AND STANDARDS OF

PROFESSIONAL CONDUCT GUIDANCE FOR STANDARDS I–VII

STANDARDS III(D) AND III(E)

III(D) Performance Presentation.

Guidance - avoid misstating performance or misleading clients/prospects about investment performance, should not state or imply the ability to achieve

a rate of return similar to that achieved in the past. For brief presentations, you must make detailed information available on request and indicate that the

presentation has offered limited information (Watch out for representativity bias, survivorship bias and time periods.)

Recommended Procedures for Compliance

Encourage firms to adhere to GIPS. Obligations under this Standard may also be met by:

• Considering the sophistication of the audience to whom a performance presentation is addressed.

• Presenting performance of weighted composite of similar portfolios rather than a single account.

• Including terminated accounts as part of historical performance and clearly stating when they were terminated.

1

• Including all appropriate disclosures to fully explain results (e.g., model results included, gross or net of fees, etc.).

• Maintaining data and records used to calculate the performance being presented.

Application of Standard III(D) Performance Presentation

Vignette 1:

Kyle Taylor of Taylor Trust Company, noting the performance of Taylor’s common trust fund for the past two years, states in the brochure sent to his

potential clients that “You can expect steady 25% annual compound growth of the value of your investments over the year.” Taylor Trust’s common trust

fund did increase at the rate of 25% per annum for the past year which mirrored the increase of the entire market. The fund, however, never averaged

that growth for more than one year, and the average rate of growth of all of its trust accounts for five years was 5% per annum.

Analysis:

• Taylor’s brochure is in violation of Standard III(D).

• Taylor should have disclosed that the 25% growth occurred in only one year (time period).

• Additionally, Taylor did not include client accounts other than those in the firm’s common trust fund (representativity). A general claim of firm

performance should take into account the performance of all categories of accounts.

• Finally, by stating that clients can expect a steady 25% annual compound growth rate, Taylor also violated Standard I(C), which prohibits statements of

assurances or guarantees regarding an investment.

Review examples 2-5