Page 37 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 37

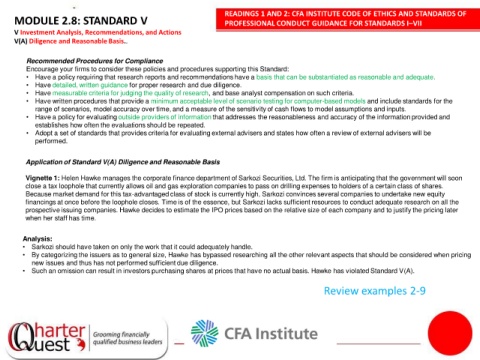

READINGS 1 AND 2: CFA INSTITUTE CODE OF ETHICS AND STANDARDS OF

MODULE 2.8: STANDARD V PROFESSIONAL CONDUCT GUIDANCE FOR STANDARDS I–VII

V Investment Analysis, Recommendations, and Actions

V(A) Diligence and Reasonable Basis..

Recommended Procedures for Compliance

Encourage your firms to consider these policies and procedures supporting this Standard:

• Have a policy requiring that research reports and recommendations have a basis that can be substantiated as reasonable and adequate.

• Have detailed, written guidance for proper research and due diligence.

• Have measurable criteria for judging the quality of research, and base analyst compensation on such criteria.

• Have written procedures that provide a minimum acceptable level of scenario testing for computer-based models and include standards for the

range of scenarios, model accuracy over time, and a measure of the sensitivity of cash flows to model assumptions and inputs.

• Have a policy for evaluating outside providers of information that addresses the reasonableness and accuracy of the information provided and

establishes how often the evaluations should be repeated.

• Adopt a set of standards that provides criteria for evaluating external advisers and states how often a review of external advisers will be

performed.

1

Application of Standard V(A) Diligence and Reasonable Basis

Vignette 1: Helen Hawke manages the corporate finance department of Sarkozi Securities, Ltd. The firm is anticipating that the government will soon

close a tax loophole that currently allows oil and gas exploration companies to pass on drilling expenses to holders of a certain class of shares.

Because market demand for this tax-advantaged class of stock is currently high, Sarkozi convinces several companies to undertake new equity

financings at once before the loophole closes. Time is of the essence, but Sarkozi lacks sufficient resources to conduct adequate research on all the

prospective issuing companies. Hawke decides to estimate the IPO prices based on the relative size of each company and to justify the pricing later

when her staff has time.

Analysis:

• Sarkozi should have taken on only the work that it could adequately handle.

• By categorizing the issuers as to general size, Hawke has bypassed researching all the other relevant aspects that should be considered when pricing

new issues and thus has not performed sufficient due diligence.

• Such an omission can result in investors purchasing shares at prices that have no actual basis. Hawke has violated Standard V(A).

Review examples 2-9