Page 42 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 42

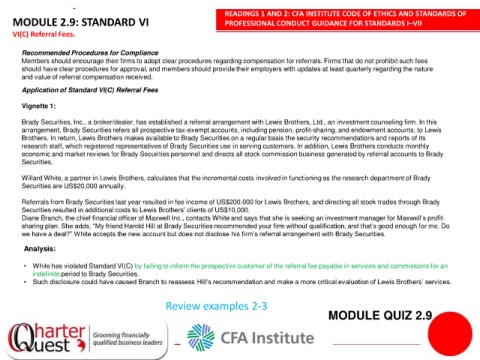

READINGS 1 AND 2: CFA INSTITUTE CODE OF ETHICS AND STANDARDS OF

MODULE 2.9: STANDARD VI PROFESSIONAL CONDUCT GUIDANCE FOR STANDARDS I–VII

VI(C) Referral Fees.

Recommended Procedures for Compliance

Members should encourage their firms to adopt clear procedures regarding compensation for referrals. Firms that do not prohibit such fees

should have clear procedures for approval, and members should provide their employers with updates at least quarterly regarding the nature

and value of referral compensation received.

Application of Standard VI(C) Referral Fees

Vignette 1:

Brady Securities, Inc., a broker/dealer, has established a referral arrangement with Lewis Brothers, Ltd., an investment counseling firm. In this

arrangement, Brady Securities refers all prospective tax-exempt accounts, including pension, profit-sharing, and endowment accounts, to Lewis

Brothers. In return, Lewis Brothers makes available to Brady Securities on a regular basis the security recommendations and reports of its

1

research staff, which registered representatives of Brady Securities use in serving customers. In addition, Lewis Brothers conducts monthly

economic and market reviews for Brady Securities personnel and directs all stock commission business generated by referral accounts to Brady

Securities.

Willard White, a partner in Lewis Brothers, calculates that the incremental costs involved in functioning as the research department of Brady

Securities are US$20,000 annually.

Referrals from Brady Securities last year resulted in fee income of US$200,000 for Lewis Brothers, and directing all stock trades through Brady

Securities resulted in additional costs to Lewis Brothers’ clients of US$10,000.

Diane Branch, the chief financial officer of Maxwell Inc., contacts White and says that she is seeking an investment manager for Maxwell’s profit-

sharing plan. She adds, “My friend Harold Hill at Brady Securities recommended your firm without qualification, and that’s good enough for me. Do

we have a deal?” White accepts the new account but does not disclose his firm’s referral arrangement with Brady Securities.

Analysis:

• White has violated Standard VI(C) by failing to inform the prospective customer of the referral fee payable in services and commissions for an

indefinite period to Brady Securities.

• Such disclosure could have caused Branch to reassess Hill’s recommendation and make a more critical evaluation of Lewis Brothers’ services.

Review examples 2-3

MODULE QUIZ 2.9