Page 46 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 46

MODULE 3.1: READING 3: APPLICATION OF THE CODE & STANDARDS

ETHICS CASE STUDIES

LOS 3.a: Evaluate policies and practices for a firm and an individual in relation to the CFA Institute Code of Ethics and

Standards of Professional Conduct.

LOS 3.b: Explain the appropriate action to take in response to conduct that violates the CFA Institute Code of Ethics and

Standards of Professional Conduct.

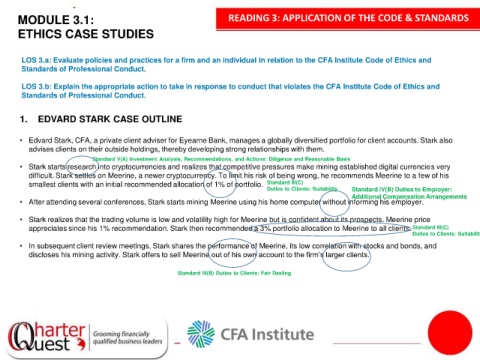

1. EDVARD STARK CASE OUTLINE

• Edvard Stark, CFA, a private client adviser for Eyearne Bank, manages a globally diversified portfolio for client accounts. Stark also

1

advises clients on their outside holdings, thereby developing strong relationships with them.

Standard V(A) Investment Analysis, Recommendations, and Actions: Diligence and Reasonable Basis

• Stark starts research into cryptocurrencies and realizes that competitive pressures make mining established digital currencies very

difficult. Stark settles on Meerine, a newer cryptocurrency. To limit his risk of being wrong, he recommends Meerine to a few of his

smallest clients with an initial recommended allocation of 1% of portfolio. Standard III(C)

Duties to Clients: Suitability Standard IV(B) Duties to Employer:

Additional Compensation Arrangements

• After attending several conferences, Stark starts mining Meerine using his home computer without informing his employer.

• Stark realizes that the trading volume is low and volatility high for Meerine but is confident about its prospects. Meerine price

appreciates since his 1% recommendation. Stark then recommended a 3% portfolio allocation to Meerine to all clients. Standard III(C)

Duties to Clients: Suitability

• In subsequent client review meetings, Stark shares the performance of Meerine, its low correlation with stocks and bonds, and

discloses his mining activity. Stark offers to sell Meerine out of his own account to the firm’s larger clients.

Standard III(B) Duties to Clients: Fair Dealing