Page 49 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 49

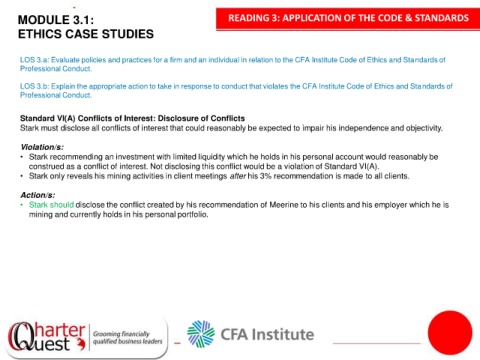

MODULE 3.1: READING 3: APPLICATION OF THE CODE & STANDARDS

ETHICS CASE STUDIES

LOS 3.a: Evaluate policies and practices for a firm and an individual in relation to the CFA Institute Code of Ethics and Standards of

Professional Conduct.

LOS 3.b: Explain the appropriate action to take in response to conduct that violates the CFA Institute Code of Ethics and Standards of

Professional Conduct.

Standard VI(A) Conflicts of Interest: Disclosure of Conflicts

Stark must disclose all conflicts of interest that could reasonably be expected to impair his independence and objectivity.

1

Violation/s:

• Stark recommending an investment with limited liquidity which he holds in his personal account would reasonably be

construed as a conflict of interest. Not disclosing this conflict would be a violation of Standard VI(A).

• Stark only reveals his mining activities in client meetings after his 3% recommendation is made to all clients.

Action/s:

• Stark should disclose the conflict created by his recommendation of Meerine to his clients and his employer which he is

mining and currently holds in his personal portfolio.