Page 50 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 50

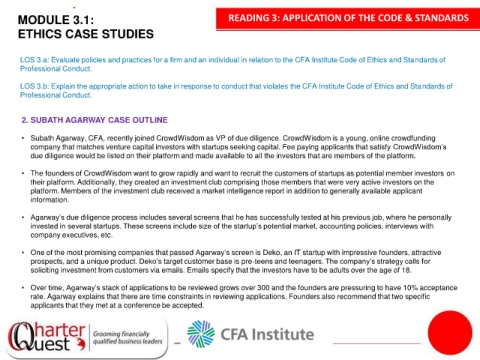

MODULE 3.1: READING 3: APPLICATION OF THE CODE & STANDARDS

ETHICS CASE STUDIES

LOS 3.a: Evaluate policies and practices for a firm and an individual in relation to the CFA Institute Code of Ethics and Standards of

Professional Conduct.

LOS 3.b: Explain the appropriate action to take in response to conduct that violates the CFA Institute Code of Ethics and Standards of

Professional Conduct.

2. SUBATH AGARWAY CASE OUTLINE

• Subath Agarway, CFA, recently joined CrowdWisdom as VP of due diligence. CrowdWisdom is a young, online crowdfunding

1

company that matches venture capital investors with startups seeking capital. Fee paying applicants that satisfy CrowdWisdom’s

due diligence would be listed on their platform and made available to all the investors that are members of the platform.

• The founders of CrowdWisdom want to grow rapidly and want to recruit the customers of startups as potential member investors on

their platform. Additionally, they created an investment club comprising those members that were very active investors on the

platform. Members of the investment club received a market intelligence report in addition to generally available applicant

information.

• Agarway’s due diligence process includes several screens that he has successfully tested at his previous job, where he personally

invested in several startups. These screens include size of the startup’s potential market, accounting policies, interviews with

company executives, etc.

• One of the most promising companies that passed Agarway’s screen is Deko, an IT startup with impressive founders, attractive

prospects, and a unique product. Deko’s target customer base is pre-teens and teenagers. The company’s strategy calls for

soliciting investment from customers via emails. Emails specify that the investors have to be adults over the age of 18.

• Over time, Agarway’s stack of applications to be reviewed grows over 300 and the founders are pressuring to have 10% acceptance

rate. Agarway explains that there are time constraints in reviewing applications. Founders also recommend that two specific

applicants that they met at a conference be accepted.