Page 47 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 47

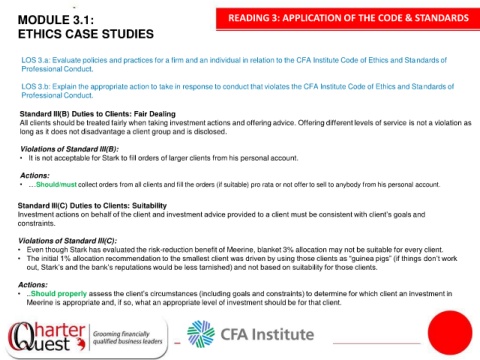

MODULE 3.1: READING 3: APPLICATION OF THE CODE & STANDARDS

ETHICS CASE STUDIES

LOS 3.a: Evaluate policies and practices for a firm and an individual in relation to the CFA Institute Code of Ethics and Standards of

Professional Conduct.

LOS 3.b: Explain the appropriate action to take in response to conduct that violates the CFA Institute Code of Ethics and Standards of

Professional Conduct.

Standard III(B) Duties to Clients: Fair Dealing

All clients should be treated fairly when taking investment actions and offering advice. Offering different levels of service is not a violation as

long as it does not disadvantage a client group and is disclosed.

1

Violations of Standard III(B):

• It is not acceptable for Stark to fill orders of larger clients from his personal account.

Actions:

• …Should/must collect orders from all clients and fill the orders (if suitable) pro rata or not offer to sell to anybody from his personal account.

Standard III(C) Duties to Clients: Suitability

Investment actions on behalf of the client and investment advice provided to a client must be consistent with client’s goals and

constraints.

Violations of Standard III(C):

• Even though Stark has evaluated the risk-reduction benefit of Meerine, blanket 3% allocation may not be suitable for every client.

• The initial 1% allocation recommendation to the smallest client was driven by using those clients as “guinea pigs” (if things don’t work

out, Stark’s and the bank’s reputations would be less tarnished) and not based on suitability for those clients.

Actions:

• ..Should properly assess the client’s circumstances (including goals and constraints) to determine for which client an investment in

Meerine is appropriate and, if so, what an appropriate level of investment should be for that client.