Page 39 - FINAL CFA II SLIDES JUNE 2019 DAY 1

P. 39

READINGS 1 AND 2: CFA INSTITUTE CODE OF ETHICS AND STANDARDS OF

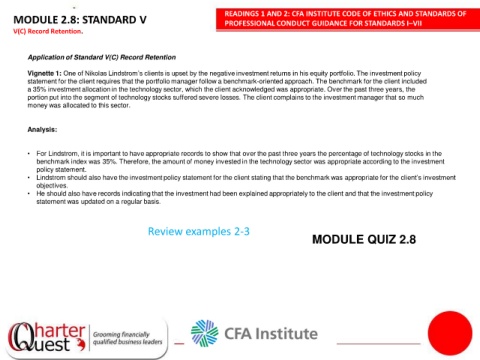

MODULE 2.8: STANDARD V PROFESSIONAL CONDUCT GUIDANCE FOR STANDARDS I–VII

V(C) Record Retention.

Application of Standard V(C) Record Retention

Vignette 1: One of Nikolas Lindstrom’s clients is upset by the negative investment returns in his equity portfolio. The investment policy

statement for the client requires that the portfolio manager follow a benchmark-oriented approach. The benchmark for the client included

a 35% investment allocation in the technology sector, which the client acknowledged was appropriate. Over the past three years, the

portion put into the segment of technology stocks suffered severe losses. The client complains to the investment manager that so much

money was allocated to this sector.

Analysis:

1

• For Lindstrom, it is important to have appropriate records to show that over the past three years the percentage of technology stocks in the

benchmark index was 35%. Therefore, the amount of money invested in the technology sector was appropriate according to the investment

policy statement.

• Lindstrom should also have the investment policy statement for the client stating that the benchmark was appropriate for the client’s investment

objectives.

• He should also have records indicating that the investment had been explained appropriately to the client and that the investment policy

statement was updated on a regular basis.

Review examples 2-3

MODULE QUIZ 2.8