Page 12 - FINAL CFA I SLIDES JUNE 2019 DAY 6

P. 12

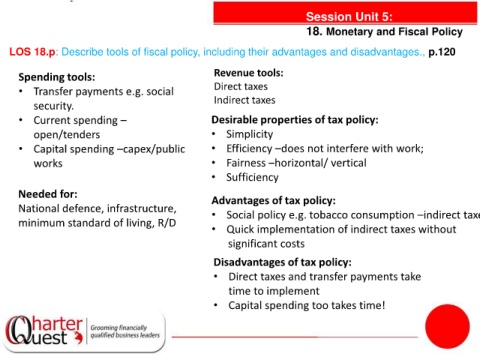

Session Unit 5:

18. Monetary and Fiscal Policy

LOS 18.p: Describe tools of fiscal policy, including their advantages and disadvantages., p.120

Spending tools: Revenue tools:

Direct taxes

• Transfer payments e.g. social

Indirect taxes

security.

• Current spending – Desirable properties of tax policy:

open/tenders • Simplicity

• Capital spending –capex/public • Efficiency –does not interfere with work;

works • Fairness –horizontal/ vertical

• Sufficiency

Needed for:

Advantages of tax policy:

National defence, infrastructure, • Social policy e.g. tobacco consumption –indirect taxes

minimum standard of living, R/D

• Quick implementation of indirect taxes without

significant costs

Disadvantages of tax policy:

• Direct taxes and transfer payments take

time to implement

• Capital spending too takes time!