Page 13 - FINAL CFA I SLIDES JUNE 2019 DAY 6

P. 13

Session Unit 5:

18. Monetary and Fiscal Policy

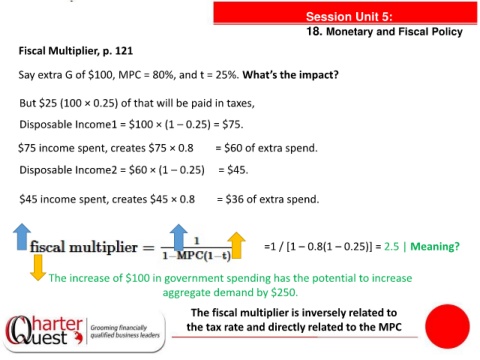

Fiscal Multiplier, p. 121

Say extra G of $100, MPC = 80%, and t = 25%. What’s the impact?

But $25 (100 × 0.25) of that will be paid in taxes,

Disposable Income1 = $100 × (1 – 0.25) = $75.

$75 income spent, creates $75 × 0.8 = $60 of extra spend.

Disposable Income2 = $60 × (1 – 0.25) = $45.

$45 income spent, creates $45 × 0.8 = $36 of extra spend.

=1 / [1 – 0.8(1 – 0.25)] = 2.5 | Meaning?

The increase of $100 in government spending has the potential to increase

aggregate demand by $250.

The fiscal multiplier is inversely related to

the tax rate and directly related to the MPC