Page 14 - FINAL CFA I SLIDES JUNE 2019 DAY 6

P. 14

Session Unit 5:

18. Monetary and Fiscal Policy

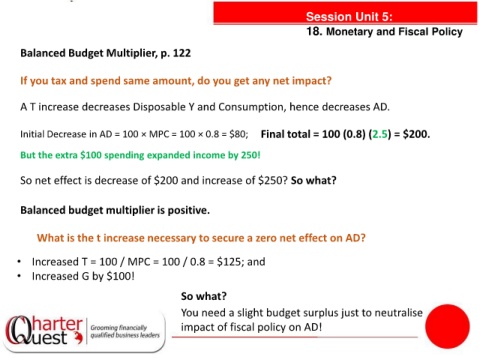

Balanced Budget Multiplier, p. 122

If you tax and spend same amount, do you get any net impact?

A T increase decreases Disposable Y and Consumption, hence decreases AD.

Initial Decrease in AD = 100 × MPC = 100 × 0.8 = $80; Final total = 100 (0.8) (2.5) = $200.

But the extra $100 spending expanded income by 250!

So net effect is decrease of $200 and increase of $250? So what?

Balanced budget multiplier is positive.

What is the t increase necessary to secure a zero net effect on AD?

• Increased T = 100 / MPC = 100 / 0.8 = $125; and

• Increased G by $100!

So what?

You need a slight budget surplus just to neutralise

impact of fiscal policy on AD!