Page 20 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 20

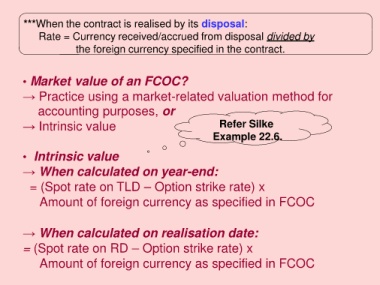

***When the contract is realised by its disposal:

Rate = Currency received/accrued from disposal divided by

the foreign currency specified in the contract.

• Market value of an FCOC?

→ Practice using a market-related valuation method for

accounting purposes, or

→ Intrinsic value Refer Silke

Example 22.6.

• Intrinsic value

→ When calculated on year-end:

= (Spot rate on TLD – Option strike rate) x

Amount of foreign currency as specified in FCOC

→ When calculated on realisation date:

= (Spot rate on RD – Option strike rate) x

Amount of foreign currency as specified in FCOC