Page 25 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 25

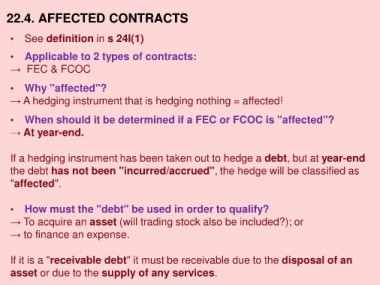

22.4. AFFECTED CONTRACTS

• See definition in s 24I(1)

• Applicable to 2 types of contracts:

→ FEC & FCOC

• Why "affected"?

→ A hedging instrument that is hedging nothing = affected!

• When should it be determined if a FEC or FCOC is "affected"?

→ At year-end.

If a hedging instrument has been taken out to hedge a debt, but at year-end

the debt has not been "incurred/accrued", the hedge will be classified as

"affected".

• How must the "debt" be used in order to qualify?

→ To acquire an asset (will trading stock also be included?); or

→ to finance an expense.

If it is a "receivable debt" it must be receivable due to the disposal of an

asset or due to the supply of any services.