Page 28 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 28

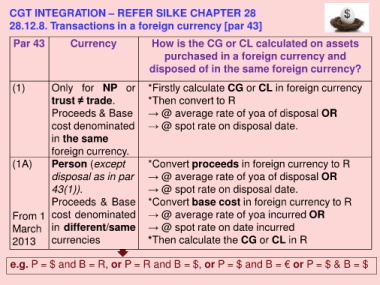

CGT INTEGRATION – REFER SILKE CHAPTER 28

28.12.8. Transactions in a foreign currency [par 43]

Par 43 Currency How is the CG or CL calculated on assets

purchased in a foreign currency and

disposed of in the same foreign currency?

(1) Only for NP or *Firstly calculate CG or CL in foreign currency

trust ≠ trade. *Then convert to R

Proceeds & Base → @ average rate of yoa of disposal OR

cost denominated → @ spot rate on disposal date.

in the same

foreign currency.

(1A) Person (except *Convert proceeds in foreign currency to R

disposal as in par → @ average rate of yoa of disposal OR

43(1)). → @ spot rate on disposal date.

Proceeds & Base *Convert base cost in foreign currency to R

From 1 cost denominated → @ average rate of yoa incurred OR

March in different/same → @ spot rate on date incurred

2013 currencies *Then calculate the CG or CL in R

e.g. P = $ and B = R, or P = R and B = $, or P = $ and B = € or P = $ & B = $