Page 27 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 27

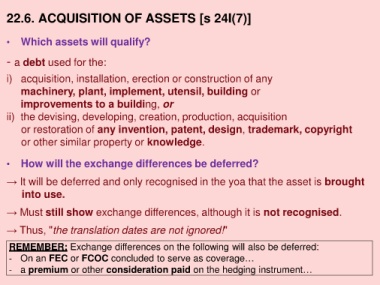

22.6. ACQUISITION OF ASSETS [s 24I(7)]

• Which assets will qualify?

- a debt used for the:

i) acquisition, installation, erection or construction of any

machinery, plant, implement, utensil, building or

improvements to a building, or

ii) the devising, developing, creation, production, acquisition

or restoration of any invention, patent, design, trademark, copyright

or other similar property or knowledge.

• How will the exchange differences be deferred?

→ It will be deferred and only recognised in the yoa that the asset is brought

into use.

→ Must still show exchange differences, although it is not recognised.

→ Thus, "the translation dates are not ignored!"

REMEMBER: Exchange differences on the following will also be deferred:

- On an FEC or FCOC concluded to serve as coverage…

- a premium or other consideration paid on the hedging instrument…