Page 26 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 26

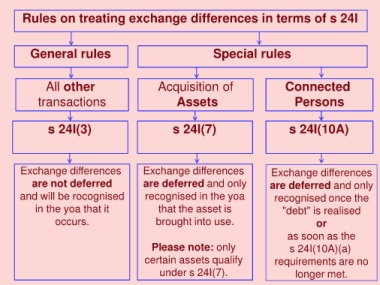

Rules on treating exchange differences in terms of s 24I

General rules Special rules

All other Acquisition of Connected

transactions Assets Persons

s 24I(3) s 24I(7) s 24I(10A)

Exchange differences Exchange differences Exchange differences

are not deferred are deferred and only are deferred and only

and will be rocognised recognised in the yoa recognised once the

in the yoa that it that the asset is "debt" is realised

occurs. brought into use. or

as soon as the

Please note: only s 24I(10A)(a)

certain assets qualify requirements are no

under s 24I(7). longer met.