Page 23 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 23

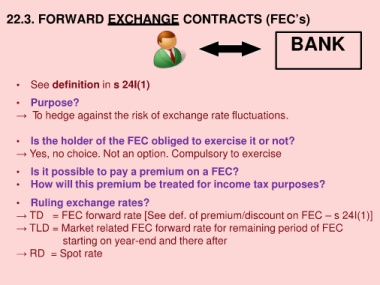

22.3. FORWARD EXCHANGE CONTRACTS (FEC’s)

BANK

• See definition in s 24I(1)

• Purpose?

→ To hedge against the risk of exchange rate fluctuations.

• Is the holder of the FEC obliged to exercise it or not?

→ Yes, no choice. Not an option. Compulsory to exercise

• Is it possible to pay a premium on a FEC?

• How will this premium be treated for income tax purposes?

• Ruling exchange rates?

→ TD = FEC forward rate [See def. of premium/discount on FEC – s 24I(1)]

→ TLD = Market related FEC forward rate for remaining period of FEC

starting on year-end and there after

→ RD = Spot rate