Page 46 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 46

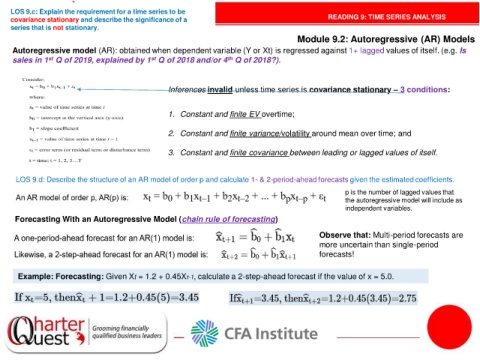

LOS 9.c: Explain the requirement for a time series to be

covariance stationary and describe the significance of a READING 9: TIME SERIES ANALYSIS

series that is not stationary.

Module 9.2: Autoregressive (AR) Models

Autoregressive model (AR): obtained when dependent variable (Y or Xt) is regressed against 1+ lagged values of itself. (e.g. Is

st

st

sales in 1 Q of 2019, explained by 1 Q of 2018 and/or 4 Q of 2018?).

th

Inferences invalid unless time series is covariance stationary – 3 conditions:

1. Constant and finite EV overtime;

2. Constant and finite variance/volatility around mean over time; and

%

3. Constant and finite covariance between leading or lagged values of itself.

LOS 9.d: Describe the structure of an AR model of order p and calculate 1- & 2-period-ahead forecasts given the estimated coefficients.

p is the number of lagged values that

the autoregressive model will include as

independent variables.

Forecasting With an Autoregressive Model (chain rule of forecasting)

Observe that: Multi-period forecasts are

more uncertain than single-period

forecasts!

Example: Forecasting: Given Xt = 1.2 + 0.45Xt-1, calculate a 2-step-ahead forecast if the value of x = 5.0.