Page 63 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 63

LOS 10.g: Compare scenario analysis, decision trees,

and simulations. READING 10: PROBABILISTIC APPROACHES: SCENARIO ANALYSIS, DECISION TREES, AND SIMULATIONS

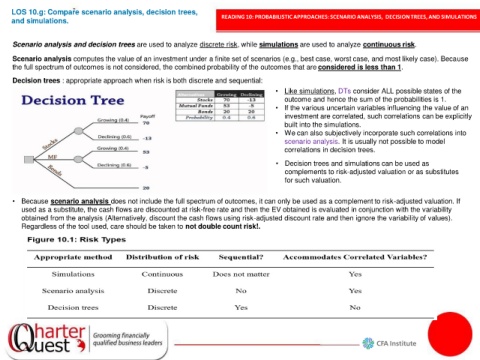

Scenario analysis and decision trees are used to analyze discrete risk, while simulations are used to analyze continuous risk.

Scenario analysis computes the value of an investment under a finite set of scenarios (e.g., best case, worst case, and most likely case). Because

the full spectrum of outcomes is not considered, the combined probability of the outcomes that are considered is less than 1.

Decision trees : appropriate approach when risk is both discrete and sequential:

• Like simulations, DTs consider ALL possible states of the

outcome and hence the sum of the probabilities is 1.

• If the various uncertain variables influencing the value of an

investment are correlated, such correlations can be explicitly

built into the simulations.

• We can also subjectively incorporate such correlations into

scenario analysis. It is usually not possible to model

correlations in decision trees.

• Decision trees and simulations can be used as

complements to risk-adjusted valuation or as substitutes

for such valuation.

• Because scenario analysis does not include the full spectrum of outcomes, it can only be used as a complement to risk-adjusted valuation. If

used as a substitute, the cash flows are discounted at risk-free rate and then the EV obtained is evaluated in conjunction with the variability

obtained from the analysis (Alternatively, discount the cash flows using risk-adjusted discount rate and then ignore the variability of values).

Regardless of the tool used, care should be taken to not double count risk!.