Page 59 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 59

LOS 9.n: Explain how time-series variables should be READING 9: TIME SERIES ANALYSIS

analyzed for non-stationarity and/or cointegration before

use in a linear regression.

Occasionally, an analyst will run a regression using two time series (2 different variables): We now have 2 different time series (y and x )..

t

t

• Use market model (x ) to estimate the equity beta for a stock, and

t

• Regresses stock’s returns (y ) on a time series of returns for the market (x ). Either or both could be subject to non-stationarity.

t

t

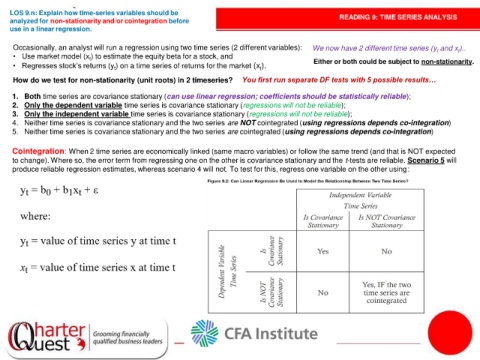

How do we test for non-stationarity (unit roots) in 2 timeseries? You first run separate DF tests with 5 possible results…

1. Both time series are covariance stationary (can use linear regression; coefficients should be statistically reliable);

2. Only the dependent variable time series is covariance stationary (regressions will not be reliable);

3. Only the independent variable time series is covariance stationary (regressions will not be reliable);

4. Neither time series is covariance stationary and the two series are NOT cointegrated (using regressions depends co-integration)

5. Neither time series is covariance stationary and the two series are cointegrated (using regressions depends co-integration)

Cointegration: When 2 time series are economically linked (same macro variables) or follow the same trend (and that is NOT expected

to change). Where so, the error term from regressing one on the other is covariance stationary and the t-tests are reliable. Scenario 5 will

produce reliable regression estimates, whereas scenario 4 will not. To test for this, regress one variable on the other using: