Page 58 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 58

LOS 9.m: Explain autoregressive conditional

heteroskedasticity (ARCH) and describe how ARCH models READING 9: TIME SERIES ANALYSIS

can be applied to predict the variance of a time series.

MODULE 9.5: ARCH AND MULTIPLE TIME SERIES

Predicting the Variance of a Time Series

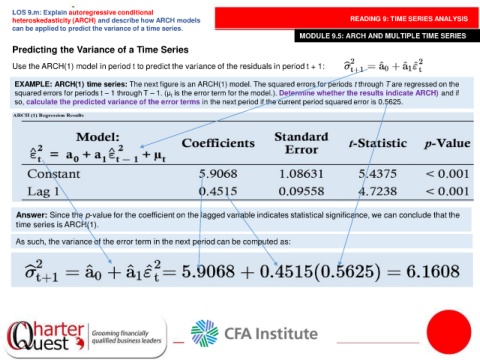

Use the ARCH(1) model in period t to predict the variance of the residuals in period t + 1:

EXAMPLE: ARCH(1) time series: The next figure is an ARCH(1) model. The squared errors for periods t through T are regressed on the

squared errors for periods t – 1 through T – 1. (μ is the error term for the model.). Determine whether the results indicate ARCH) and if

t

so, calculate the predicted variance of the error terms in the next period if the current period squared error is 0.5625.

Answer: Since the p-value for the coefficient on the lagged variable indicates statistical significance, we can conclude that the

time series is ARCH(1).

As such, the variance of the error term in the next period can be computed as: