Page 12 - CIMA MCS Workbook August 2018 - Day 1 Suggested Solutions

P. 12

CIMA NOVEMBER 2018 – OPERATIONAL CASE STUDY

CHAPTER SIX – F1

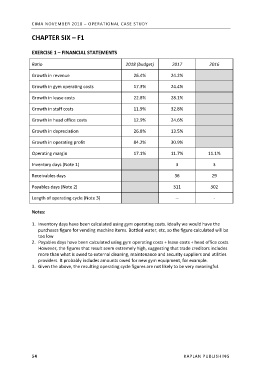

EXERCISE 1 – FINANCIAL STATEMENTS

Ratio 2018 (budget) 2017 2016

Growth in revenue 26.4% 24.2%

Growth in gym operating costs 17.3% 24.4%

Growth in lease costs 22.8% 28.1%

Growth in staff costs 11.9% 32.8%

Growth in head office costs 12.9% 24.6%

Growth in depreciation 26.8% 13.5%

Growth in operating profit 84.2% 30.9%

Operating margin 17.1% 11.7% 11.1%

Inventory days (Note 1) 3 3

Receivables days 36 29

Payables days (Note 2) 311 302

Length of operating cycle (Note 3) -- -

Notes:

1. Inventory days have been calculated using gym operating costs. Ideally we would have the

purchases figure for vending machine items. Bottled water, etc, so the figure calculated will be

too low

2. Payables days have been calculated using gym operating costs + lease costs + head office costs.

However, the figures that result seem extremely high, suggesting that trade creditors includes

more than what is owed to external cleaning, maintenance and security suppliers and utilities

providers. It probably includes amounts owed for new gym equipment, for example.

3. Given the above, the resulting operating cycle figures are not likely to be very meaningful.

54 KAPLAN PUBLISHING