Page 27 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 27

Session Unit 16:

54. Understanding Fixed Income Risk and Return (B/B)C)

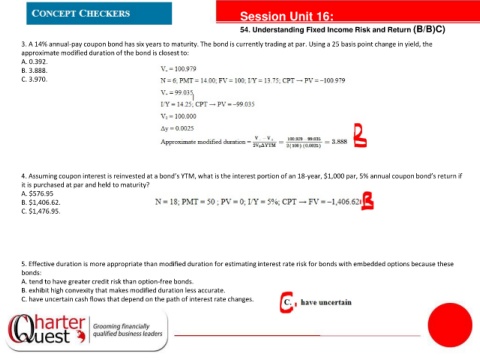

3. A 14% annual-pay coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, the

approximate modified duration of the bond is closest to:

A. 0.392.

B. 3.888.

C. 3.970.

tanties

4. Assuming coupon interest is reinvested at a bond’s YTM, what is the interest portion of an 18-year, $1,000 par, 5% annual coupon bond’s return if

it is purchased at par and held to maturity?

A. $576.95

B. $1,406.62.

C. $1,476.95.

5. Effective duration is more appropriate than modified duration for estimating interest rate risk for bonds with embedded options because these

bonds:

A. tend to have greater credit risk than option-free bonds.

B. exhibit high convexity that makes modified duration less accurate.

C. have uncertain cash flows that depend on the path of interest rate changes.