Page 28 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 28

Session Unit 16:

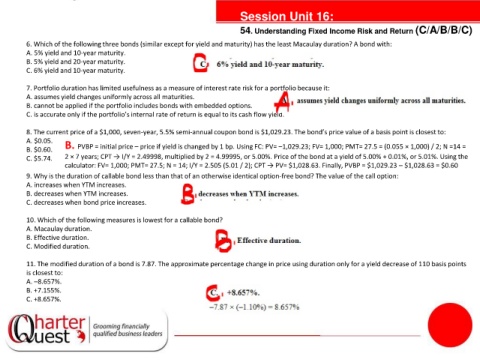

54. Understanding Fixed Income Risk and Return (C/A/B/B/C)

6. Which of the following three bonds (similar except for yield and maturity) has the least Macaulay duration? A bond with:

A. 5% yield and 10-year maturity.

B. 5% yield and 20-year maturity.

C. 6% yield and 10-year maturity.

7. Portfolio duration has limited usefulness as a measure of interest rate risk for a portfolio because it:

A. assumes yield changes uniformly across all maturities.

B. cannot be applied if the portfolio includes bonds with embedded options.

C. is accurate only if the portfolio’s internal rate of return is equal to its cash flow yield.

8. The current price of a $1,000, seven-year, 5.5% semi-annual coupon bond is $1,029.23. The bond’s price value of a basis point is closest to:

A. $0.05.

tanties

B. $0.60. B. PVBP = initial price – price if yield is changed by 1 bp. Using FC: PV= –1,029.23; FV= 1,000; PMT= 27.5 = (0.055 × 1,000) / 2; N =14 =

C. $5.74. 2 × 7 years; CPT → I/Y = 2.49998, multiplied by 2 = 4.99995, or 5.00%. Price of the bond at a yield of 5.00% + 0.01%, or 5.01%. Using the

calculator: FV= 1,000; PMT= 27.5; N = 14; I/Y = 2.505 (5.01 / 2); CPT → PV= $1,028.63. Finally, PVBP = $1,029.23 – $1,028.63 = $0.60

9. Why is the duration of callable bond less than that of an otherwise identical option-free bond? The value of the call option:

A. increases when YTM increases.

B. decreases when YTM increases.

C. decreases when bond price increases.

10. Which of the following measures is lowest for a callable bond?

A. Macaulay duration.

B. Effective duration.

C. Modified duration.

11. The modified duration of a bond is 7.87. The approximate percentage change in price using duration only for a yield decrease of 110 basis points

is closest to:

A. –8.657%.

B. +7.155%.

C. +8.657%.